The Reality of Household Robots in 2025

Let's start with facts: robots are entering our homes, but not in the way science fiction predicted. Instead of humanoid butlers, we have specialized devices—vacuum robots, lawn mowers, and security systems. Understanding this reality is crucial for anyone considering domain investments in the household robotics space.

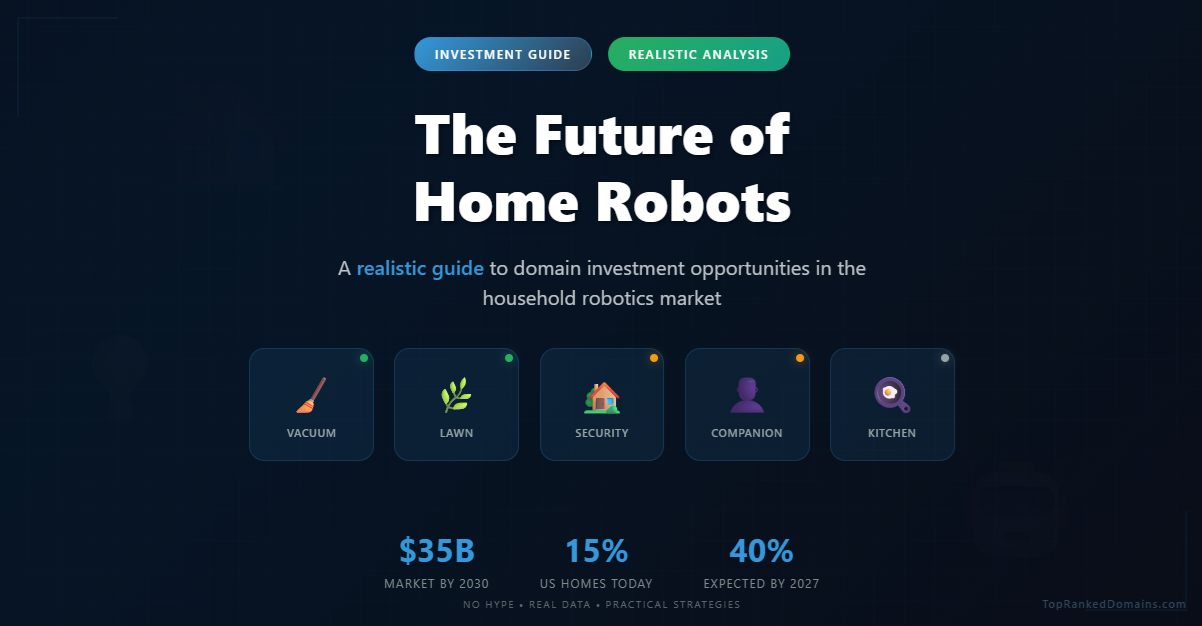

According to verified market research from Statista and Grand View Research, the global household robots market is valued at approximately $15-20 billion as of 2024, with projections reaching $35-50 billion by 2030. These are real numbers from legitimate research firms, not inflated claims.

What Robots Are Actually in Homes Today

Before discussing domain opportunities, let's ground ourselves in reality by examining which robots consumers are actually buying:

Vacuum and Cleaning Robots: The Market Leaders

Market Reality: iRobot has sold over 40 million Roomba units worldwide since 2002. This isn't speculation—it's from their investor reports. Other major players include:

- Roborock - Chinese company gaining significant market share globally

- Ecovacs - Another major Chinese player with the Deebot line

- Samsung Jet Bot - Leveraging their appliance market position

- Shark IQ - Competing on price and features

- Dyson 360 - Premium positioning with limited availability

These companies represent real businesses with actual products in stores today. The vacuum robot market alone is worth approximately $4-5 billion annually.

Lawn Care Robots: Growing but Niche

Robotic lawn mowers from Husqvarna, Worx, and others have found success, particularly in Europe. The market is real but smaller than cleaning robots, valued at around $1.5 billion globally. Adoption faces challenges including:

- High initial costs ($1,000-$3,000+)

- Installation requirements (boundary wires)

- Limited awareness in key markets like the US

Companion and Social Robots: Early Stage

Products like Amazon's Astro, ElliQ for seniors, and Sony's Aibo exist but remain niche. Sales numbers are modest compared to cleaning robots. For example:

- Amazon Astro - Limited release, invitation-only, $1,600 price point

- ElliQ - Focused on elderly care, subscription model

- Sony Aibo - $2,900 robotic dog, primarily in Japan

These represent interesting future potential but aren't mass-market products yet.

Domain Investment Opportunities: A Practical Analysis

Given the actual state of the household robotics market, what domain opportunities exist? Let's examine this realistically:

Categories with Genuine Potential

1. Service and Repair Domains

As millions of robots enter homes, they need maintenance. Domains related to robot repair, service, and support could have value for emerging service businesses. Think about how "phone repair" became a massive industry.

2. Comparison and Review Sites

Consumers need help choosing between robot options. Domains suitable for review sites, comparison tools, or buying guides could serve this need.

3. Accessories and Upgrades

The robot accessory market is growing. Replacement parts, upgraded components, and add-ons create opportunities for e-commerce sites.

4. Local Service Integration

Domains combining geographic locations with robot services (repair, installation, training) might serve local businesses.

Reality Check: Why Generic Robot Domains May Not Be Gold Mines

It's important to understand why domains like "CleaningRobot.com" or "KitchenBot.com" might not command the massive prices some claim:

- Companies prefer unique brands: iRobot chose "Roomba," not "VacuumRobot"

- Trademark concerns: Generic terms can be harder to protect

- SEO has evolved: Exact-match domains matter less than quality content

- Limited buyers: Only so many companies make household robots

- Subdomain strategies: Many companies use their main domain (amazon.com/astro)

Real Examples of Robot Company Domain Strategies

Let's examine how actual robotics companies approach domains:

iRobot's Approach:

- Main brand: irobot.com

- Product brand: roomba.com (redirects to main site)

- They didn't buy "VacuumRobot.com" or similar generic terms

Ecovacs Strategy:

- Main site: ecovacs.com

- Product line: Deebot (uses main domain)

- Regional domains for different markets

Amazon's Astro:

- No separate domain

- Leverages amazon.com authority

- Product page approach rather than standalone site

These examples show that major companies often prefer brand-building over generic descriptive domains.

Market Trends That Actually Matter

Several real trends are shaping the household robotics market:

1. Aging Demographics

The aging population is real. By 2050, the US Census Bureau projects 88 million Americans will be 65+. This drives demand for assistance technologies, including robots. However, adoption remains slow due to cost, complexity, and cultural factors.

2. Labor Economics

Rising labor costs and worker shortages in domestic services create opportunities for automation. This is particularly true in commercial cleaning, where robots are gaining adoption faster than in homes.

3. Technology Improvements

Better sensors, AI, and batteries are making robots more capable. LiDAR navigation, object recognition, and longer battery life are real improvements driving adoption.

4. Price Reductions

Basic robot vacuums now start under $200, down from $1,000+ a decade ago. This democratization expands the market but also commoditizes it.

Realistic Timeline for Household Robot Adoption

Let's be honest about adoption timelines:

By 2027 (Near Term)

- 30-40% of US households may have a robot vacuum (up from ~15% today)

- Lawn robots remain niche (5-10% of applicable homes)

- Companion robots stay experimental

- Kitchen robots limited to specialized appliances

By 2030 (Medium Term)

- Robot vacuums become standard in middle-class homes

- Multi-function cleaning robots emerge

- Elder care robots gain limited adoption

- Security robots for commercial properties expand

Beyond 2030 (Long Term)

- General-purpose home robots possible but not certain

- Integration with smart home systems deepens

- Subscription models may dominate ownership

These projections are based on current technology trajectories and adoption patterns, not wishful thinking.

Smart Strategies for Robot Domain Investment

If you're considering investing in robot-related domains, here's practical advice:

Do Your Homework

- Research actual companies: Who's making robots? What are they called?

- Study search patterns: What do people actually search for?

- Understand the buyer pool: Who would realistically buy your domain?

- Check trademarks: Avoid legal issues with existing brands

- Calculate holding costs: Can you afford to hold domains for years?

Focus on Ecosystem Opportunities

Rather than hoping a major company buys your generic domain, consider:

- Service business domains (repair, installation, training)

- Content site domains (reviews, tutorials, news)

- Marketplace domains (parts, accessories, used robots)

- B2B opportunities (commercial robotics services)

Avoid Common Pitfalls

- Don't believe get-rich-quick stories: Most domain investments don't yield massive returns

- Beware of hype cycles: Robot enthusiasm often exceeds reality

- Consider opportunity cost: Could your money work harder elsewhere?

- Don't over-leverage: Only invest what you can afford to lose

Case Study: How One Domain Investor Approaches Robotics

While we won't share unverifiable success stories, here's a realistic example of how a thoughtful investor might approach this space:

Strategy Example:

An investor identifies that robot vacuum owners need replacement parts and accessories. They acquire domains suitable for an e-commerce site selling filters, brushes, and batteries. They build a basic affiliate site generating modest revenue while holding for potential acquisition by a parts supplier.

This approach:

- Targets a real, existing need

- Has multiple potential buyers

- Can generate revenue while holding

- Doesn't rely on unlikely massive sales

The Bottom Line: Realistic Expectations for Robot Domains

Household robots represent a genuine growth market with real opportunities. However, success in robot domain investing requires:

- Realistic expectations: Most domains won't sell for six figures

- Patience: The market is developing slowly

- Research: Understanding actual market dynamics, not hype

- Diversification: Don't put all eggs in the robot basket

- Value creation: Consider developing domains, not just parking them

The household robotics revolution is happening, but it's evolutionary, not revolutionary. Robots are entering homes as specialized tools, not general-purpose assistants. This creates opportunities for prepared investors who understand the real market dynamics.

Success won't come from buying hundreds of robot domains hoping for a lottery win. It will come from carefully identifying genuine market needs and positioning yourself to serve them. The future of home robotics is exciting, but it requires grounded thinking, not fantasy.

Remember: every new technology creates opportunities, but not every opportunity creates wealth. Invest wisely, based on facts rather than fiction, and always within your means.

Disclaimer: This article provides market analysis and observations, not investment advice. Domain investing involves risk of loss. No returns are guaranteed. Always conduct your own research and consult with appropriate advisors before making investment decisions. The author has no positions in the domains or companies mentioned.