The Real State of Household Robotics in 2025

Walk into any major electronics retailer today, and you'll find an entire section dedicated to home robots. From iRobot's latest Roomba models to Samsung's Jet Bot AI+ vacuum cleaners, robots are no longer science fiction—they're becoming standard household appliances.

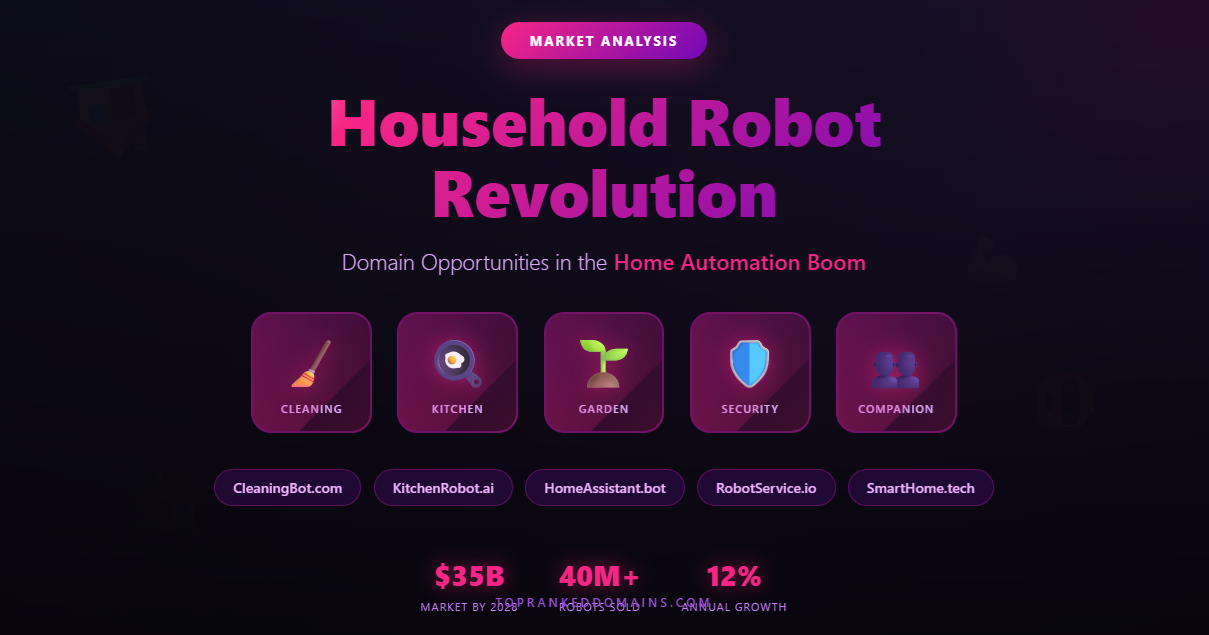

The household robotics market is experiencing genuine growth. According to Statista, the global household robots market is projected to reach approximately $35 billion by 2028. While we're not quite at the 'Jetsons' level of home automation, the proliferation of robotic devices in homes creates interesting opportunities for domain investors who understand where this market is heading.

Current Household Robots: What's Actually in Homes Today

Before exploring domain opportunities, let's look at what robots are actually entering homes right now:

Cleaning Robots - The Current Market Leaders

Vacuum Robots:

- iRobot Roomba - The market leader with over 40 million units sold globally

- Roborock - Premium vacuum/mop combinations gaining market share

- Ecovacs Deebot - Popular mid-range options with advanced navigation

- Samsung Jet Bot - Leveraging AI and object recognition

- Shark IQ Robot - Self-emptying models at competitive prices

These aren't hypothetical products—they're in millions of homes right now, creating a proven market for cleaning robotics.

Window Cleaning Robots:

Companies like Hobot and Ecovacs have introduced window-cleaning robots, though adoption remains niche compared to vacuum robots.

Lawn Care Robots

Robotic lawn mowers from Husqvarna, Worx, and Robomow are gaining traction, particularly in Europe where they're becoming as common as robotic vacuums. The global robotic lawn mower market is expected to grow at a CAGR of over 12% through 2030.

Kitchen and Food Robots

While not autonomous in the traditional sense, smart kitchen appliances are incorporating robotic elements:

- Moley Robotics - Developing the world's first robotic kitchen (though still in limited release)

- PicoBrew - Automated brewing systems (though the company has faced challenges)

- Smart ovens from companies like June and Tovala with automated cooking programs

Companion and Social Robots

This emerging category includes:

- Amazon Astro - Home monitoring and assistance robot (limited availability)

- ElliQ - Companion robot for elderly individuals

- Vector by Digital Dream Labs - Educational and entertainment robot

- Sony's Aibo - Robotic pet companion

Domain Opportunities in Household Robotics: A Strategic Analysis

The growth of household robotics creates domain opportunities, but successful investment requires understanding both the technology and consumer behavior patterns.

Categories Worth Considering

1. Task-Specific Robot Domains

Domains that describe specific household tasks robots can perform have potential value because they match how consumers search for solutions. Consider how people search: "robot vacuum cleaner," "robotic lawn mower," "automated pet feeder."

2. Brand-Agnostic Category Domains

As the market matures, category-defining domains may become valuable for retailers, review sites, or comparison platforms. Think about how "smartphones.com" or "laptops.com" would be valuable today.

3. Geographic + Robotics Combinations

Local service and support for household robots is becoming important. Domains combining geographic locations with robot services could have value for local businesses.

4. Robot Service and Maintenance Domains

As more homes adopt robots, services for repair, maintenance, and upgrades will grow. Domains in this space might serve the emerging robot service industry.

Real Companies and Their Domain Strategies

Examining how actual companies approach their domain strategy provides insights:

iRobot (irobot.com): Simple, brandable domain that's become synonymous with vacuum robots. They also own roomba.com for their flagship product.

Ecovacs (ecovacs.com): Brand-focused approach with product-specific domains like deebot.com for their vacuum line.

Roborock (roborock.com): Descriptive brand name that immediately conveys robotics focus.

Amazon Astro: Leverages Amazon's main domain with a subdomain strategy (amazon.com/astro).

Notice that established companies typically choose brandable domains rather than generic descriptive ones. This suggests that while category domains might have value for aggregators or review sites, individual companies often prefer unique brand identities.

Market Trends Driving Domain Value

Several genuine trends are influencing the household robotics space:

Aging Population

The global population aged 65 and older is growing rapidly. This demographic drives demand for assistance robots, creating opportunities in elder care robotics domains. Companies like Intuition Robotics (makers of ElliQ) are specifically targeting this market.

Labor Shortages

Shortages in domestic help and rising labor costs make household robots more economically attractive. This trend particularly affects cleaning and lawn care robotics.

Technology Convergence

AI, computer vision, and improved sensors are making robots more capable. The integration of robots with smart home ecosystems (Alexa, Google Home) is creating new use cases.

Subscription Models

Robot-as-a-Service (RaaS) models are emerging. iRobot's Select membership and similar programs suggest domains related to robot subscriptions might gain value.

Realistic Investment Considerations

While household robotics presents opportunities, domain investors should understand the realities:

Challenges to Consider

- Brand Preference: Major companies often create unique brand names rather than buying generic domains

- Market Timing: Some categories (like humanoid home robots) may be years from mainstream adoption

- Competition: Established investors and companies are also aware of these opportunities

- Liquidity: Niche robotics domains may have limited buyer pools

- Technology Risk: Some robot categories may never achieve mass adoption

Opportunities Worth Exploring

- Service Ecosystem: Domains related to robot repair, programming, and customization

- Education and Content: How-to sites, review platforms, and comparison services

- B2B Applications: Commercial cleaning robots, security robots for businesses

- Integration Platforms: Domains focused on connecting multiple robots or smart home integration

Extension Strategies for Robotics Domains

Different extensions serve different purposes in the robotics space:

.com Extensions: Still the gold standard for commercial ventures. Most established robotics companies use .com domains.

.ai Extensions: Particularly relevant for AI-powered robots. Companies like Covariant (covariant.ai) leverage this for branding.

.bot Extensions: Natural fit for robotics, though adoption has been slower than some predicted.

.io Extensions: Popular among robotics startups and developer tools.

Country-specific extensions matter for local robot service businesses, as robot repair and support often require physical presence.

Due Diligence for Robotics Domain Investment

Before investing in household robotics domains:

Research Steps

- Study actual products: Understand what robots are really being sold and adopted

- Analyze search patterns: Use tools like Google Trends to understand how people search for household robots

- Monitor industry news: Follow robotics publications and trade shows for emerging trends

- Track funding: Watch which robotics startups receive investment

- Understand regulations: Some robot categories face regulatory hurdles that affect adoption

Red Flags to Avoid

- Domains based on hypothetical products that don't exist

- Over-investing in a single robot category

- Ignoring trademark issues with existing robot brands

- Assuming all robot categories will achieve mass adoption

- Neglecting renewal costs for large portfolios

Future Outlook: Where Household Robotics Is Actually Heading

Based on current technology and market trends, here's a realistic outlook:

Near Term (2025-2027)

- Continued growth in cleaning robots with improved AI and navigation

- Expansion of lawn care robots in suburban markets

- Limited rollout of kitchen assistance robots

- Growth in elder care companion robots

- Integration of robots with smart home ecosystems

Medium Term (2027-2030)

- Multi-function robots that combine cleaning, security, and assistance

- Improved human-robot interaction through better AI

- Subscription models becoming standard

- Emergence of robot management platforms

- Growing aftermarket for robot accessories and upgrades

Realistic Adoption Curves

Unlike smartphones, which achieved near-universal adoption quickly, household robots face different challenges:

- Higher price points ($300-$3,000 for most current robots)

- Physical space requirements

- Maintenance and technical complexity

- Cultural acceptance varies by region

- Actual utility versus novelty factor

Practical Advice for Domain Investors

If you're considering investing in household robotics domains:

Start Small and Specific

Rather than trying to buy every robot-related domain, focus on specific categories where you see genuine market activity. For example, if lawn care robots are growing in your region, that might be a focused area to explore.

Consider Development

Domains with quality content about household robots may be more valuable than parked domains. Consider creating review sites, comparison tools, or educational content.

Network Strategically

Attend robotics trade shows, join online communities, and build relationships in the industry. Understanding the market helps identify genuine opportunities.

Maintain Realistic Expectations

While some domains may indeed become valuable, expecting massive returns on every robotics domain is unrealistic. Like any investment, diversification and patience are key.

Conclusion: A Measured Approach to Robotics Domain Investment

The household robotics revolution is real, but it's evolving more gradually than science fiction predicted. Robots are entering our homes, but primarily as specialized tools rather than general-purpose assistants. This creates genuine opportunities for domain investors, but success requires understanding the actual market rather than speculation about distant futures.

The key is to focus on domains that serve real needs in the emerging household robotics ecosystem: product categories that exist, services that robots require, and platforms that connect robots with users. Avoid speculation on hypothetical products and instead ground investment decisions in observable market trends.

As major companies from iRobot to Samsung continue pushing robotics into homes, and startups innovate in new categories, the domain landscape around household robotics will continue evolving. Smart investors who understand both the technology and the market dynamics can find opportunities—just remember that not every robot domain will become the next goldmine.

The robots are indeed coming home. The opportunity for domain investors is to thoughtfully identify which digital real estate will matter as this transformation unfolds.

Disclaimer: This article presents market analysis and observations. It is not investment advice. Domain investing carries risks, including total loss of investment. Always conduct thorough research and consider your financial situation before making investment decisions. Past performance in any market does not guarantee future results.